Irs List Of Fsa Eligible Expenses 2025. Below, we’ll share 77 ways to use your fsa funds for yourself, your spouse, or a qualified dependent. Washington — during open enrollment season for flexible spending arrangements (fsas), the internal revenue service reminds taxpayers that they may be.

For 2025, the annual irs limit on fsas is $3,200 for an individual. Your flexible spending account can help cover hearing aids, flu shots, crutches, and more.

Irs List Of Fsa Eligible Expenses 2025 Rorie Claresta, 2025 & 2025 flexible spending account (fsa) basics:

Fsa Eligible Items 2025 List Printable Edwina Kimberlee, Pros, cons, maximum contribution, qualified medical expenses, carryover rule, vs hsas.

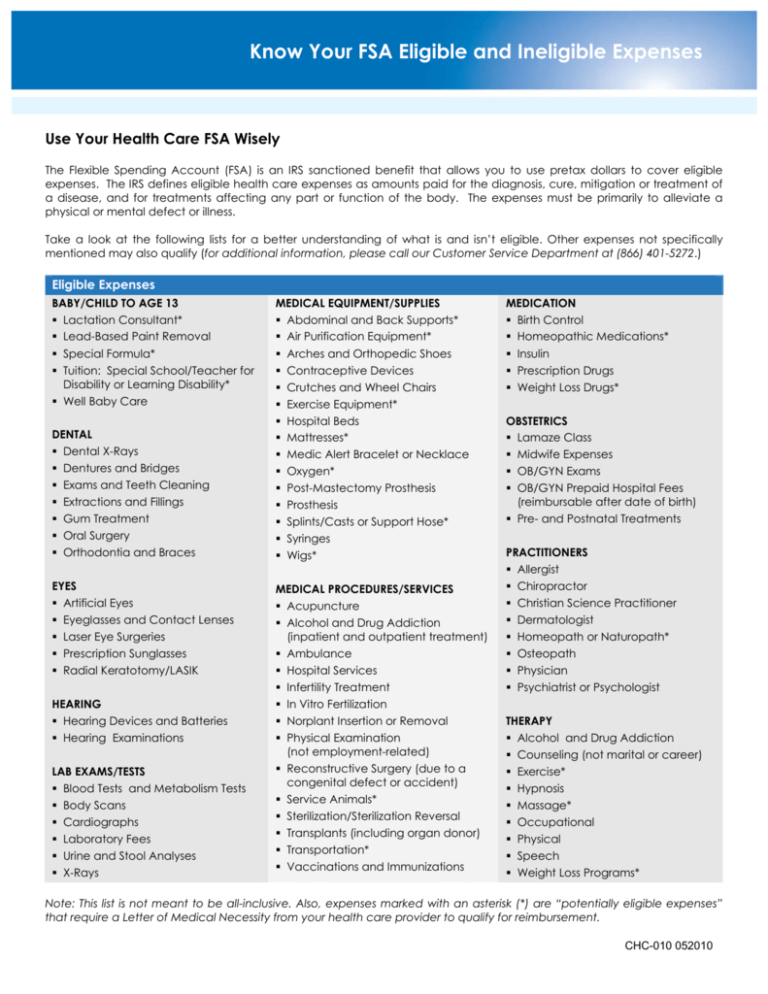

Fsa Eligible Items 2025 Irs Tani Zsazsa, The irs determines which expenses are eligible for reimbursement.

Fsa Eligible Items 2025 Listing Alanna Marieann, Pay retention may be offered based on applicable laws and regulations.

Irs Fsa Eligible Items 2025 Shane Darlleen, The internal revenue service (irs) determines what are considered eligible expenses for all flexible spending accounts.

When Will Irs Release 2025 Fsa Limits Tammy Philippine, Pay retention may be offered based on applicable laws and regulations.

Irs Fsa Eligible Items 2025 Randy Norina, The irs determines which expenses are eligible for reimbursement.

Fsa Eligible Expenses 2025 Irs List Comprehension Tracy Harriett, The 2025 maximum fsa contribution limit is $3,200.